Introduction

One of the first concepts people encounter when learning about money is inflation—or more precisely, how inflation affects your savings and purchasing power.

Everyone, without exception, has experienced the impact of rising prices for goods and services over time—either directly or indirectly.

That’s why it’s completely normal to look for effective ways to protect your money from inflation and minimize its negative effects.

In this anti-inflation guide, we’ll explore:

- Why inflation is a sneaky enemy

- How to defend your money from inflation

- The best investments to beat inflation

- The single best long-term investment to protect your savings and grow your wealth

Why inflation is a sneaky enemy

Are the savings in your bank account truly safe?

Most people would say:

“Absolutely yes! My bank is solid, and even if it were to go bankrupt, deposits up to €100,000 are protected by the Interbank Deposit Protection Fund.”

That’s a technically correct answer—those funds are indeed protected from what’s known as bank credit risk.

But it’s only half the truth. Because credit risk isn’t the only threat to your money.

There’s another, much quieter enemy—stealthy, invisible, and constant—that erodes the value of your savings over time:

👉 Inflation.

What Is Inflation, and Why It’s Dangerous

Inflation is the general increase in prices over time, which leads to a decrease in your purchasing power.

In other words, the same amount of money will buy you less and less as time goes by.

Your savings might stay the same in nominal terms—€1,000 today will still be €1,000 tomorrow—but in real value, they’re shrinking.

This is why we say that inflation erodes purchasing power.

Example: The Real Cost of Keeping Money in the Bank

Let’s look at a real-world example:

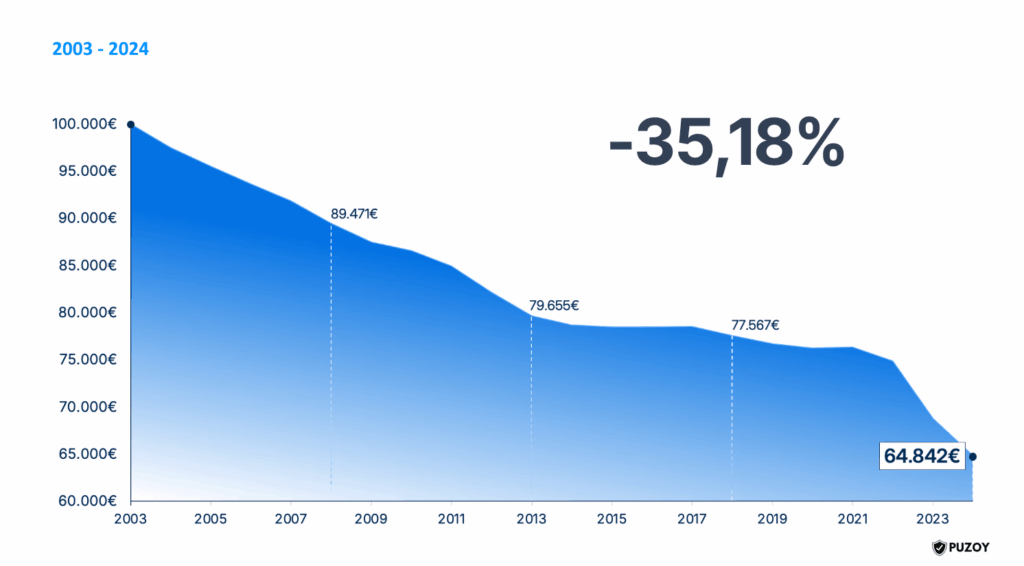

If you had €100,000 sitting in a bank account since 2003 and didn’t touch it, today you’d have lost over 35% of its purchasing power.

That means those €100,000 are now worth roughly €65,000 in real terms.

And this is a guaranteed loss—unlike market volatility, where you can recover or even profit, inflation is a one-way, irreversible erosion.

What About Rising Wages?

You might be thinking:

“Sure, inflation decreases my purchasing power, but don’t salaries go up too, offsetting that loss?”

Good question.

In some countries, yes—wages have kept pace with inflation. But in Italy, that’s not the case.

📉 In Italy, salaries have been stagnant for 20+ years.

So while prices have steadily increased, wages have remained flat. That means no natural compensation for the loss in purchasing power.

So, What Can You Do?

Are we doomed to watch our savings shrink?

Absolutely not.

There’s a powerful tool to protect and even grow your wealth over time:

👉 Investing.

And in the next sections, we’ll explore how to fight inflation and what the best inflation-proof investments are for the long term.

How to defend your money from inflation

Let’s debunk a common myth right away:

Inflation cannot be beaten in the short term.

At least, not today, not tomorrow, and not with certainty.

Why?

Because fighting inflation would require us to predict or control it—and that’s simply not possible.

You can’t just wake up and decide that inflation won’t affect you anymore.

No one can tell with precision what the inflation rate will be next month, next year, or five years from now.

Even central banks, which set monetary policies aiming to keep inflation within “healthy” levels, rarely hit their targets exactly.

Short-Term Strategy: Limit Its Impact

So, what can you do?

In the short term, your goal shouldn’t be to beat inflation—but to limit its negative effects.

The best way to do this is through budgeting:

- Track your income and expenses carefully

- Identify and reduce non-essential spending

- Make smart decisions about your daily consumption habits

These small changes won’t eliminate inflation, but they can protect your financial stability and help you maintain a consistent saving capacity.

Long-Term Strategy: Invest to Beat Inflation

Now here comes the good news.

While inflation is impossible to control or predict in the short term, in the medium to long term you can absolutely fight back—and even come out ahead.

How?

👉 By investing your money in the financial markets.

Smart, long-term investments can not only preserve your purchasing power but also generate returns that outperform inflation over time.

So, What Are the Best Inflation-Proof Investments?

That’s exactly what we’ll cover in the next section:

👉 The most effective investment strategies to protect your wealth from inflation and make your money grow.

The best investments to beat inflation

Before we dive into the top inflation-proof investments, it’s important to understand a key concept:

👉 The economy moves in cycles.

These economic cycles alternate over time and are shaped by four main macroeconomic conditions:

- Inflation

- Deflation

- Economic growth

- Economic slowdown

Each unique combination of these factors defines a different “economic season.”

Understanding Economic Seasons

Just like in nature, the economy goes through four main “seasons”, each with its own characteristics and challenges.

And just like you wouldn’t wear a winter coat in summer, your investment strategy should adapt to the economic climate.

Here’s how it works:

- In times of strong economic growth, certain investments thrive.

- During a recession, other assets become more defensive and reliable.

- Some investments perform well during high inflation.

- Others are better suited to low inflation or deflationary environments.

Understanding these shifts is essential if you want to protect your wealth from inflation and make smart, long-term investment choices.

What Assets Perform Well During Inflation?

So, let’s get to the key question:

👉 Which investments actually perform well when inflation rises?

We’ll go through each asset class and explore how it behaves in different economic seasons—especially during periods of high inflation.

Get ready to discover:

- Which assets protect your purchasing power

- Which ones can generate inflation-beating returns

- How to structure your portfolio to weather economic changes

⬇️ In the next section, we’ll break down the top-performing inflation-resistant investments, one by one.

1. Gold: The Classic Inflation Hedge

Gold has long been considered a safe haven asset—a timeless store of value that investors turn to during periods of economic uncertainty and rising prices.

While the correlation between gold and inflation isn’t always perfect, gold tends to perform well during high-inflation environments. That’s because, unlike paper currency, gold cannot be printed and its supply grows slowly over time.

📌 Key takeaway:

Gold doesn’t generate income, but it can help preserve purchasing power over the long term.

2. Commodities: Raw Materials That Ride the Inflation Wave

Commodities are the raw materials at the core of the global economy. Common examples include:

- Oil

- Natural gas

- Copper

- Wheat

- Iron

When inflation rises, it’s often due to increased demand for goods and services. As a result, the price of the commodities used to produce those goods tends to rise as well.

This makes investing in commodities one of the most direct ways to benefit from inflationary trends.

📌 Key takeaway:

Commodities often surge when inflation spikes, especially when driven by supply shortages or global demand.

3. Inflation-Linked Bonds (TIPS)

Inflation-linked bonds, such as U.S. Treasury Inflation-Protected Securities (TIPS), are designed specifically to protect investors from inflation.

Here’s how they work:

- Both the principal and interest payments are adjusted for inflation, based on official consumer price indexes (CPI).

- At maturity, the investor receives the inflation-adjusted principal, safeguarding real purchasing power.

Because these bonds track inflation directly, they offer a predictable real return, no matter how inflation behaves.

📌 Key takeaway:

Ideal for conservative investors seeking capital preservation during inflationary periods.

Defensive Assets, But Not the Whole Picture

Gold, commodities, and inflation-linked bonds are often labeled as defensive assets. They play an important role in a diversified portfolio, especially during high inflation or market stress.

However, relying only on these asset classes isn’t the optimal long-term strategy. Why?

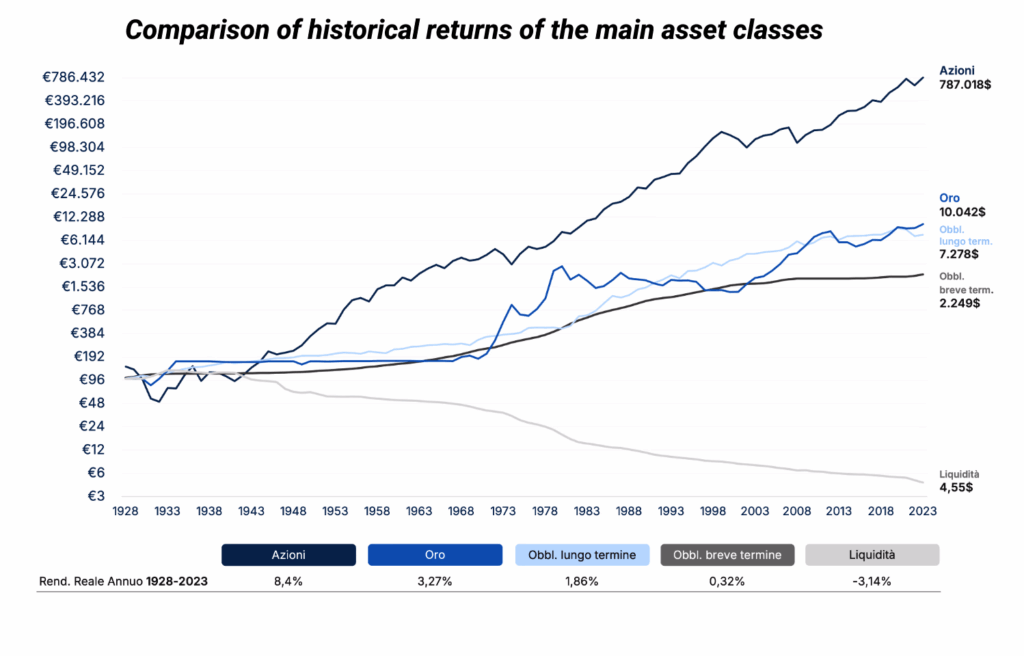

Because over the long run, there’s one asset class that has consistently outperformed inflation and generated superior returns:

👉 Equities.

In the next section, we’ll explain why stocks are one of the best long-term investments to beat inflation—and how to invest in them wisely.

The Best Long-Term Investment to Beat Inflation

When it comes to fighting inflation over the long run, there’s one asset class that stands out above all the rest:

👉 Equities (stocks).

This isn’t just a matter of opinion—the data speaks for itself.

Whether we look at the past few decades or take a century-long view, stocks have consistently outperformed inflation and delivered real returns that far exceed those of bonds, gold, or cash.

Even Warren Buffett, one of the most legendary investors of all time, reminded us at the end of the 2008–2009 financial crisis that “One of the best ways to combat inflation is to own pieces of great businesses.”

Investing in stocks—meaning owning a small share of real companies that innovate, hire talent, launch new products and services, and generate profits for their shareholders—has proven to be one of the most effective ways to protect against inflation.

Why Stocks and Not Another Asset Class?

Think about it: as a consumer, inflation hurts you.

You feel the impact of rising prices because your purchasing power decreases over time.

But what if you could shift your perspective?

What if, instead of just being the consumer (the demand side), you also acted like a seller (the supply side)—the ones offering goods and services?

To do this, all you need to do is invest in stocks. When you buy shares, you become a part-owner of the same companies you might complain about for raising their prices.

If you’re a shareholder in Apple, for example, you should actually be glad when Apple raises iPhone prices.

Not necessarily because the company wants to increase profits, but because it may need to adjust prices to keep up with rising costs—raw materials, labor, rent, and so on.

If you’re an Amazon shareholder, rising prices for Amazon Prime should be welcome news.

Companies Have Pricing Power

Most companies, to varying degrees, have pricing power—the ability to raise prices when costs increase.

Inflation goes up? Production costs rise? Employees ask for higher wages?

No problem—just raise prices.

By doing so, companies aim to maintain their revenues, profit margins, and net income. In turn, this helps sustain or increase their market valuation and shareholder dividends.

Of course, this is a simplified explanation. But it clearly illustrates how stocks, and the companies behind them, have the power to adjust and defend themselves against inflation, making them a smart long-term choice for investors.

Recap: How to Defend Your Savings from Inflation

To wrap things up, here’s how to approach the issue of inflation effectively:

1. Don’t Obsess Over Official Inflation Data

Unless you’re a politician or a professional economist, there’s little value in focusing too much on official inflation statistics. Inflation is a macroeconomic factor beyond your control.

However, you can reduce its short-term impact by managing your personal or household budget wisely.

2. Remember: Uninvested Cash Loses Value

Inflation has a significant negative impact on uninvested savings.

Money left sitting in a bank account loses purchasing power over time—steadily and inevitably—unless it’s invested.

3. Investing Is the Key—Especially in Stocks

This is why investing is essential, particularly in stocks, which have historically been the best-performing asset class to not only beat inflation but also generate returns well above it.

That said, this doesn’t mean you should rush into buying random stocks, nor that the stock market won’t experience downturns during periods of high inflation.

In fact, random investing can potentially do more harm to your wealth than inflation itself.

4. Start with a Financial Plan

Deciding which specific financial instruments to invest in should only come after you’ve created a solid financial plan.

This includes understanding:

- How much cash to keep available for daily expenses

- How much to set aside for emergencies

- And how much you can safely allocate toward your long-term financial and life goals

5. Focus on What You Can Control

You don’t need to guess whether the next economic season will bring high or low inflation.

What really matters—and what you can control—is:

- Your starting financial situation

- Your saving habits

- Your risk tolerance

- Your personal and family goals

- And the structure of your overall investment strategy

If you like this contents, please put in your bookmark puzoy.com

READ MORE –