Introduction

When choosing an insurance provider, financial stability is one of the most crucial factors to consider. AM Best, a globally recognized credit rating agency, evaluates insurance companies based on their financial strength and ability to meet policyholder obligations. For those considering Tower Hill Insurance, understanding its AM Best Ratings for Tower Hill Insurance and financial standing is essential.

In this comprehensive guide, we will analyze Tower Hill Insurance’s AM Best Ratings for Tower Hill Insurance, its financial performance, and what these ratings mean for policyholders.

What is AM Best and Why Does It Matter?

AM Best is an independent agency that assesses the financial health and creditworthiness of insurance companies. Its ratings range from A++ (Superior) to D (Poor) and reflect an insurer’s ability to pay claims and remain financially stable over time.

These ratings are critical for policyholders because they indicate whether an insurance company is financially sound and reliable, reducing the risk of policyholders facing claim payment issues during crises. AM Best Ratings for Tower Hill Insurance.

Tower Hill Insurance: Company Overview

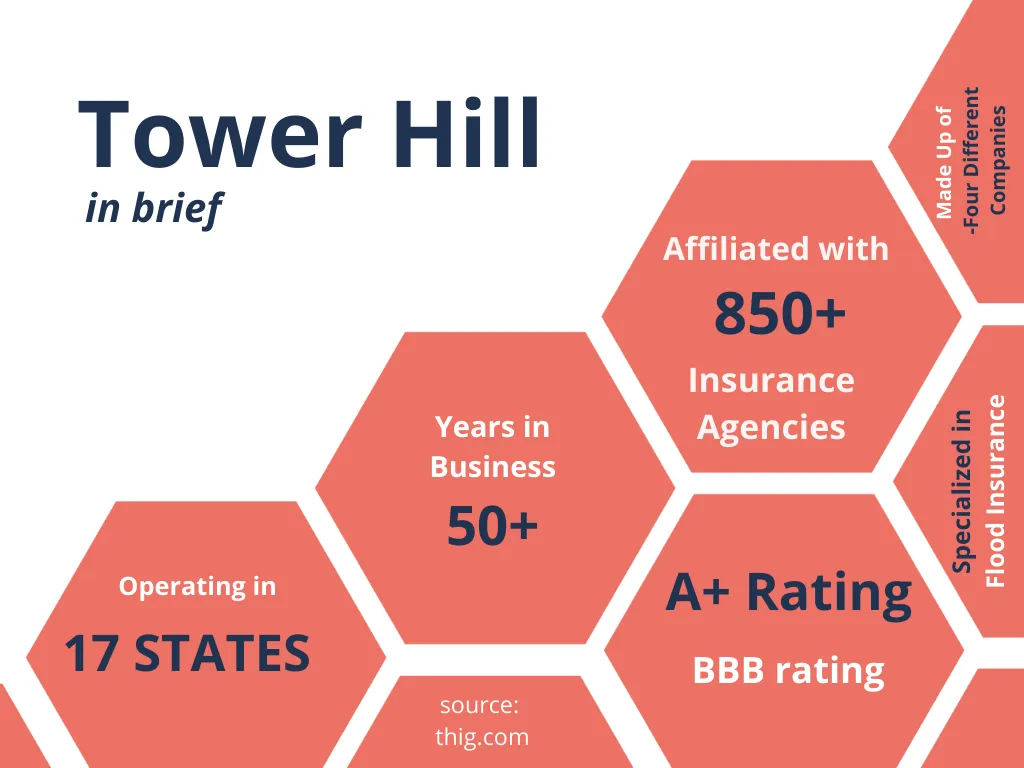

Founded in 1972, Tower Hill Insurance is a leading provider of property insurance, primarily serving homeowners in Florida. The company offers various insurance products, including:

- Homeowners Insurance

- Flood Insurance

- Dwelling Fire Insurance

- Commercial Insurance

- Condo and Renters Insurance

Tower Hill has built a strong reputation over the years, but recent AM Best Ratings for Tower Hill Insurance have raised concerns among policyholders.

AM Best Ratings for Tower Hill Insurance: A Historical Perspective

Initial High Ratings

In 2015, AM Best assigned Tower Hill Prime Insurance Company a Financial Strength Rating (FSR) of A- (Excellent) and a Long-Term Issuer Credit Rating (ICR) of “a-“.

These ratings reflected strong capitalization and effective risk management, positioning Tower Hill as a financially stable insurer in the market. (Source)

Recent Downgrades and Concerns

However, in April 2022, AM Best downgraded Tower Hill Prime Insurance Company’s ratings due to financial difficulties, including:

- FSR downgrade from B++ (Good) to B+ (Good)

- ICR downgrade from “bbb” (Good) to “bbb-” (Fair)

This downgrade was primarily due to deteriorating risk-adjusted capitalization, increased litigation costs, and higher claims volume in Florida. (Source)

By September 2022, Tower Hill faced another significant downgrade:

- FSR was lowered to B (Fair)

- ICR was further reduced to “bb” (Fair)

- Tower Hill withdrew from AM Best’s rating process

This decision to withdraw from AM Best Ratings for Tower Hill Insurance raised concerns about the insurer’s financial strength and its ability to withstand long-term financial pressures.

Why Did AM Best Downgrade Tower Hill Insurance?

The key reasons behind Tower Hill Insurance’s AM Best rating downgrade include:

- Surplus Decline – The company faced a decline in available financial reserves, impacting its ability to cover claims efficiently.

- Increased Legal Costs – Due to Florida’s challenging insurance landscape, litigation costs skyrocketed, affecting profitability.

- Hurricane Losses – Natural disasters like hurricanes have placed additional financial strain on insurers in Florida, including Tower Hill.

- Reserve Adequacy Issues – Tower Hill struggled to set adequate reserves to meet potential claim obligations.

Tower Hill’s Response: The Formation of Tower Hill Insurance Exchange

In response to the rating downgrades, Tower Hill restructured its operations by launching the Tower Hill Insurance Exchange. This new entity operates as a reciprocal insurer, meaning policyholders become members and share underwriting profits.

To reassure policyholders, the Tower Hill Insurance Exchange secured a Financial Stability Rating (FSR) of A (Exceptional) from Demotech, Inc., an alternative rating agency specializing in regional insurers. (Source)

What Does This Mean for Policyholders?

If you have a Tower Hill Insurance policy, you should be aware of the following: ✅ Lower AM Best ratings can impact policyholder confidence – Some mortgage lenders require homeowners insurance from companies with at least a B++ rating from AM Best. ✅ Higher risk for financial instability – Lower ratings indicate that the company is facing financial challenges that could affect claims processing. ✅ Alternative ratings from Demotech, Inc. – While Tower Hill has withdrawn from AM Best ratings, its A-rated stability from Demotech suggests it is still a reliable option. ✅ Policyholders should review their coverage annually – If you are concerned about the company’s financial strength, consider discussing options with an insurance agent.

Should You Choose Tower Hill Insurance?

Before making a decision, consider these factors: ✔ Financial Stability: The AM Best downgrade raises concerns, but the A rating from Demotech provides some reassurance. ✔ Claims Processing: If Tower Hill struggles financially, claims processing delays may occur. ✔ Alternative Providers: If financial strength is a major concern, consider other insurers with stronger AM Best ratings. ✔ Customer Reviews: Always check customer feedback regarding claims handling and customer service before making a final decision.

Final Thoughts: Is Tower Hill Insurance Still a Safe Choice?

Tower Hill Insurance has experienced significant rating downgrades from AM Best, raising concerns among policyholders. While the company has taken steps to restructure and stabilize, its decision to withdraw from AM Best ratings may impact its reputation. AM Best Ratings for Tower Hill Insurance.

However, Tower Hill remains a strong player in Florida’s insurance market with an A (Exceptional) rating from Demotech. If you are a policyholder, staying informed and reassessing your coverage annually is crucial. AM Best Ratings for Tower Hill Insurance.

If you prioritize financial stability, consider comparing alternative insurance providers with stronger AM Best ratings to ensure you are fully protected.

Do you currently have a Tower Hill Insurance policy? Share your experience in the comments below! VISIT – puzoy.com

READ MORE –